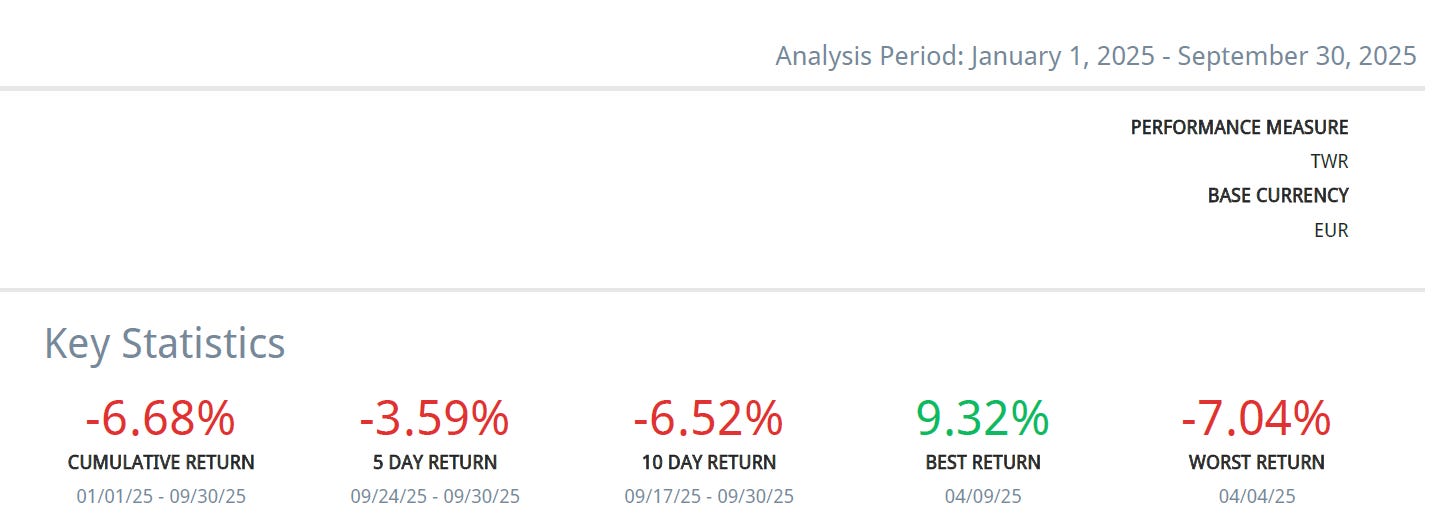

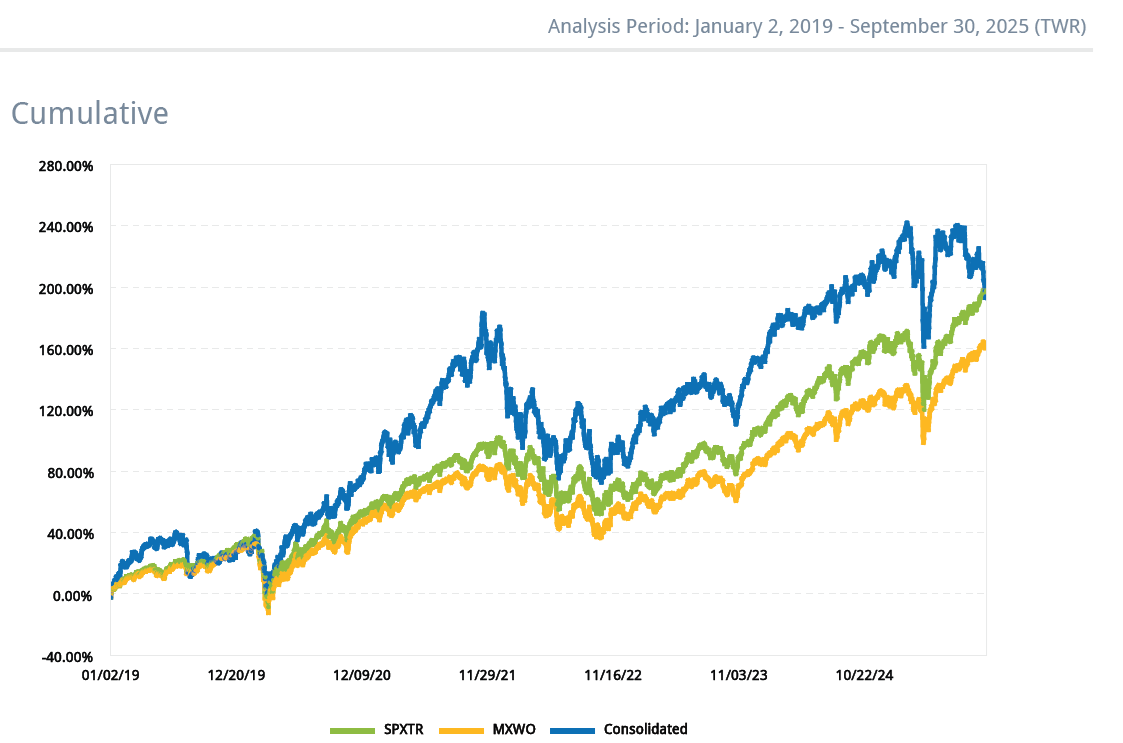

This quarter delivered rather disappointing returns, especially when compared with major indices. It’s the first time (at least since I’ve been tracking performance) that such a significant gap has opened between my portfolio and the benchmarks. I have no intention of drawing grand conclusions or indulging in the narrative that we’re living through one of the biggest bubbles in recent history. The truth is, I don’t know—and only hindsight will bring clarity.

The only factor truly within my control is the pursuit of improvement. Staying curious and relentlessly focused on learning seems a far more sensible strategy than trying to guess where we are in the cycle or which stocks will be in vogue next quarter. This isn’t a reflection triggered by recent underperformance but something that sits at the core of how I understand investing. Keeping this blog, despite the considerable time it demands, has proven to be an excellent tool for growth. The more businesses you study, the more you realize how little you actually know.

Periods of weak returns do have a silver lining, much as I hate losing money. They are ideal moments to revisit fundamentals and exercise self-criticism, though it’s essential not to draw hasty conclusions after a losing streak. It’s during these periods that the temptation to overhaul one’s entire approach is usually strongest. I’m not referring to refining the process, being more selective, or managing emotions better—those are all positive adjustments. I mean the real risk of abandoning your core strategy simply because it’s painful to watch others make money while your own capital erodes. That, in my view, is one of the hardest psychological challenges in this business.

I would argue that my core strategy hasn’t changed. However, over time, my definition of what constitutes a good business has certainly evolved, and I’m quite sure that definition is still far from complete. Today, I strive to be more selective with the companies I choose, recognizing that, out of the entire universe of stocks, only a handful are truly exceptional. Very few operate from a genuinely privileged competitive position. Growth alone (or even high returns on invested and reinvested capital) means little if the business lacks meaningful protection from competition. Without high barriers to entry, someone will eventually find a way to erode those returns. Without protection from substitution or displacement, not even an outstanding product guarantees long-term survival. In my opinion, barriers to entry are the single most important factor when evaluating any investment. Over the long term, it’s simply harder to lose money holding assets that are difficult to replace or replicate.

What remains hardest for me is learning to quickly discard ideas that don’t meet these initial filters but still look tempting—whether because of an appealing valuation, high growth expectations, or other secondary factors that shouldn’t carry such weight. And this is an area where I need to be self-critical, because I’ve made these mistakes countless times (and it’s worth acknowledging that you can make mistakes and still make money). Every listed company enjoys some form of competitive advantage—otherwise, it wouldn’t hold its current position. But not all moats are equally strong, and therefore not all businesses have the same chance of enduring over time.

As part of this ongoing reflection on what defines a resilient business, during the first and second quarters of this year I significantly increased my exposure to Vertical Market Software, taking advantage of the volatility triggered by tariff-related headlines in global markets. In hindsight, the timing couldn’t have been worse. Although concerns about the potential impact of AI had been circulating for some time, for whatever reason, they finally materialized this quarter—dragging down the average return of my portfolio, which had closed the second quarter at +6.8% YTD.

As usual, in this quarterly letter I’ll share the current composition of my portfolio. But first, I’d like to explain why I believe vertical software providers belong to that select group of truly special businesses, and offer some thoughts on how artificial intelligence might affect their future trajectory. I’m fully aware that neither my opinion (nor the market’s collective view) will alter the actual outcome for this industry. Only time will. Still, given that a significant portion of our family wealth is invested across various companies in this space, I think it’s worth sharing a few reflections after calmly analyzing the situation over the past few months. I’m not trying to persuade anyone, but perhaps someone will find these thoughts useful.

*The following content is exclusive to paid subscribers*