L'Oréal

Crafting Beauty for a Century: How L’Oréal Leverages Scale, Innovation, and Brand Equity for Long-Term Growth

Few sectors combine complexity, global scale, and cultural nuance like the beauty industry. On the surface, it may appear simple and fragmented—but behind the scenes, it's a fiercely competitive market where success hinges on mastering science, innovation, distribution, and digital marketing. L’Oréal, the undisputed global leader, has spent over a century fine-tuning that balance.

Rather than merely assembling a portfolio of iconic brands, L’Oréal has built a sophisticated industrial and commercial engine capable of identifying trends early, launching products at scale, and adapting offerings to local preferences with remarkable agility. In an environment crowded with indie brands and digital-native competitors, L’Oréal continues to gain market share—reinforcing a business model that blends the resilience of a defensive compounder with the adaptability of a startup.

Unlike consumer goods conglomerates that spread their resources across multiple categories, L’Oréal has focused all its capital, research, and strategic execution on one goal: global beauty leadership. This has resulted in a unique ecosystem—across R&D, marketing, logistics, and manufacturing—where scale amplifies not just efficiency, but learning speed and commercial effectiveness.

This analysis explores how L’Oréal has sustained its leadership for over 100 years, and why its multichannel, multicategory, multipolar strategy continues to create hard-to-replicate advantages. It also examines the structural dynamics of the beauty market, its untapped growth potential, and the risks even the most dominant players must navigate.

From ancient times, human beings have sought ways to enhance their appearance, care for their bodies, and project an image reflecting health, status, identity, or cultural affiliation. The origins of cosmetic care and beauty can be traced back to ancient civilizations, including Ancient Egypt, Mesopotamia, Greece, and Rome, where balms, oils, natural pigments, and aesthetic rituals were used not solely for adornment but also for spiritual and medicinal purposes. In Egypt, for instance, makeup held sacred and protective significance, while in Greece, bodily symmetry and harmony were associated with philosophical ideals.

Caring for one's appearance transcends mere superficiality; it is deeply intertwined with how individuals express who they are. Through their image, people communicate their personality, their culture, and how they want to be perceived. Throughout history, beauty has served as a means of self-expression, fostering confidence and facilitating connection with others. It also plays a role in marking significant life events and helping individuals find their place within society. Styling hair, applying makeup, and choosing one’s clothes are not simply routine habits; they are forms of nonverbal communication. Consequently, even as years or centuries pass, beauty will remain a natural and human way of expressing identity, belonging, and personal aspirations. It will remain an unparalleled social imperative, which underscores the economic and financial appeal of the cosmetics industry.

L'Oréal was established in 1909 by French chemist Eugène Schueller, who developed a revolutionary hair coloring formula he named "Oréal." Schueller initially founded his company as Société Française de Teintures Inoffensives pour Cheveux, reflecting his commitment to safety and innovation in cosmetic products. He personally marketed his creations to hairdressers in the French capital, and his scientific background combined with an entrepreneurial spirit laid the groundwork for what would become a global powerhouse decades later.

The company subsequently adopted the L'Oréal name, expanded its operations into new geographies, and diversified into additional beauty and personal care categories with the introduction of skincare, makeup, and fragrance products. Beyond his scientific acumen, Schueller demonstrated keen business vision. His unwavering commitment to continuous innovation and unparalleled marketing strategy propelled the brand's growth, establishing two fundamental tenets that persist in the company's strategic approach today. L'Oréal believes that beauty arises from the union of science and creativity to fulfill the evolving needs of consumers, who increasingly seek novel experiences extending beyond mere products and services.

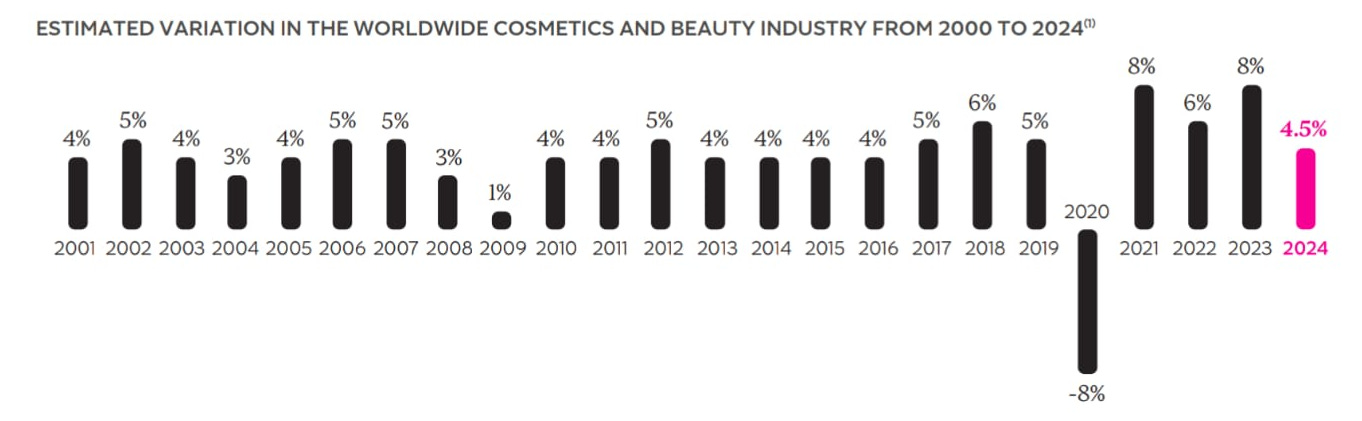

Valued at over €290 billion in 2024, the global cosmetics industry has proven to be one of the most resilient, defensive, and stable in the face of geopolitical and macroeconomic turbulence. Over the past two decades, it recorded only one year of negative growth, occurring during the pandemic-induced lockdowns when personal care temporarily became less of a priority. Even then, the downturn was moderate, with an 8% contraction. Notably, even in 2009, amidst the global financial crisis, the cosmetics and beauty market still managed to grow by 1%.

Beauty is, unquestionably, a universal pursuit and an essential category for most consumers. The participants in the cosmetics industry have successfully capitalized on this inherent human need and are strategically positioned to benefit from several favorable trends: population growth, the emergence of a global middle class, and a growing preference for higher-value products. Over the past 25 years, this market has expanded at a CAGR of 4% to 5%, and there is no indication that this growth cannot be sustained. This makes analyzing L'Oréal, the undisputed leader in the sector, particularly interesting.

L'Oréal's enduring strategy has consistently balanced the democratization and universalization of beauty with individualization. Universalization dictates that brands must maintain a global presence while incorporating regional nuances to resonate with diverse consumers. Individualization, conversely, addresses the demand for a wider array of products that cater to more personalized, less standardized needs. For over a century, the French company has amassed knowledge and best practices by focusing exclusively on the cosmetics and beauty sector. This contrasts with other significant competitors like Unilever and Procter & Gamble (ranked second and fourth globally by market share, respectively), which operate across broader categories. With a presence in over 150 countries and encompassing all product types, categories, and distribution channels, L'Oréal excels at identifying emerging trends and responding with agility.

Its innovation engine is fundamental, as merely satisfying current consumer needs isn't enough in this industry. L'Oréal seems to have discovered the key to developing pioneering products that effectively address future challenges, providing a strong justification for price increases above inflation. Historically, over a third of its annual revenue growth stems from price adjustments, thanks to the company's ability to launch new products with higher price points than their predecessors, often without a corresponding increase in production costs. In fact, its gross margin has expanded from 71% to 74% over the last decade. Consumers are less sensitive to these price increases because, in the beauty category, both affordable and luxurious products offer ways to enhance quality of life and personal comfort without a significant financial outlay. For example, purchasing a Yves Saint Laurent lipstick, an Armani foundation, or a Dior perfume is far more accessible than investing in a handbag or other accessory from these same luxury brands. This helps explain why the beauty industry thrives when the economy slows, while other sectors may suffer. The fact that L'Oréal has not cut its dividend in the past 60 years (distributing approximately 50% of its FCF in dividends) underscores not only the company's inherent strength but also the resilience of the industry itself.

However, given L'Oréal's demonstrable resilience and century-old legacy, one might mistakenly assume that we are dealing with a simple industry, when the reality is quite distinct. If beauty constitutes a fundamental social need, why then does L'Oréal find it necessary to allocate 32% of its revenue to marketing? If the industry is genuinely so stable, predictable, and profitable, why do 15-20% of the French company's sales originate from new launches? Several reasons account for this. While the pursuit of beauty is indeed a social need, brands simultaneously need to seduce consumers. Loyalty to a product or brand is the paramount driver of its profitability and longevity. The cosmetics industry is as complex as it is competitive, and analyzing it solely through a retrospective lens of how competitive advantages were established in the late last century can be counterproductive and lead to erroneous conclusions.

Competition has intensified significantly over the past two decades, primarily because currently barriers to entry are considerably low, and growth prospects remain highly attractive. Digitalization, social media, and the evolving consumer habits of contemporary generations have fostered the emergence of numerous new independent brands and novel purely online competitors that have adapted more effectively than many established brands. In the era of "social beauty," where everything is connected and shared, the pervasive influence of digital technology and social media has served as a powerful catalyst for growth within the beauty market. However, these same forces have also functioned as a Trojan horse for many brands that built their dominance in an era when television was the primary channel of consumer communication and only large corporations could afford to leverage it.

Although the top 10 cosmetics companies collectively hold nearly 60% of the global market, it is the subsequent 100 or 200 players that are fundamentally reshaping industry norms, altering the dynamics that defined this sector for decades. Newer generations of consumers are very different from their predecessors: they possess greater disposable income, demonstrate a heightened willingness to experiment with higher-quality products, and readily explore new categories. As these new generations replace previous ones, brands that have failed to adapt and meet their evolving needs risk losing the appeal they worked so hard to cultivate.

Estée Lauder is a great example of this inability to adapt and its potentially devastating consequences (link). Despite its status as one of the most recognized companies in the cosmetics sector and having experienced spectacular growth over the last decade, it is currently navigating one of the most significant crises in its recent history. Estée Lauder stands as perhaps the most compelling example of how a lack of dynamism and an outdated focus on traditional sales channels can jeopardize a nearly century-old legacy in a relatively short span.

There is no single reason that explains L'Oréal's enduring difference or its century-long dominance in the beauty sector. To understand what makes the French giant unique, we need to examine a series of factors that have been instrumental in strengthening its competitive advantages, even as its major competitors lost market share. In stark contrast to Estée Lauder's aggressive focus on specific cosmetics categories and the travel retail channel, L'Oréal has pursued a more conservative strategy, emphasizing greater diversification and balance. It distributes products across all categories and through every available distribution channel. Whatever the consumer desires, or their preferred purchase method, L'Oréal can provide it. The company has a presence in every geography (France accounts for less than 7% of the group's sales), and its product portfolio spans all categories and price ranges, from shampoos costing €4 or €5 to skin creams priced at €400.

This often undervalued strength—this invisible competitive advantage—is precisely what reduces business volatility and its cost of capital in a trend-driven industry where not all categories and geographies perform equally year after year. L'Oréal has consistently demonstrated an exceptional ability to adapt to cyclical shifts within the beauty market. Its strength lies not in its reliance on a single category or channel, but in the inherent diversity and complementarity of its brand and product portfolio. In certain years, makeup drives growth, while in others, skincare or the luxury segment take precedence. The same adaptive principle applies to sales channels: when travel retail experiences a slowdown, beauty salons or e-commerce effectively compensate. This structural flexibility ensures that a different segment can offset any specific deceleration, sustaining the group's dynamism and illustrating that L'Oréal's multi-channel and multi-category model not only mitigates risks but serves as a constant source of resilience and growth.

Having a global presence and covering all existing categories and products also plays a strategic role, enabling the company to identify trends and fleeting fads firsthand before competitors. Gathering comprehensive information to anticipate consumer needs is paramount for maintaining competitiveness and adapting to a rapidly evolving industry. In the beauty market, everything revolves around innovation. Everything revolves around offering the newest, most effective, and most glamorous product. This partly explains why between 15 and 20% of annual sales are derived from new launches.

L'Oréal possesses an innovation and marketing capacity that is remarkably difficult to replicate. Each year, it allocates over €1.4 billion to R&D (3% of total sales) and employs more than 4,200 researchers across 21 cosmetics research centers, 13 evaluation centers, and 1 advanced research center. This extensive infrastructure enabled the company to register over 694 new patents in 2024 alone. Numerous examples of innovation exist, dispelling the misconception that beauty companies merely repackage and rebrand products. For instance, after 18 years of dedicated research, L'Oréal developed Melasyl, a novel molecule engineered to address localized pigmentation issues, such as dark spots and acne scars. Its mechanism of action involves intercepting melanin precursors before their transformation into visible pigments, preventing the appearance of spots. Supported by more than 121 scientific studies, Melasyl has demonstrated efficacy across all skin tones. Leveraging its dermatological expertise, La Roche-Posay has integrated this molecule into its new MelaB3 line, now available in nearly 40 countries. This range combines a serum with an SPF 30 treatment, effectively correcting existing dark spots while simultaneously protecting the skin from UV rays, a primary factor aggravating hyperpigmentation.

Research centers also play a key role in tailoring brands to the local preferences of each market. Global product launches are uncommon in this industry because products are not standardized. Beauty is deeply cultural, influenced by climate, skin tone, and hair type specific to each population. Therefore, maintaining R&D teams in close proximity to consumers (in locations such as Brazil, South Africa, India or China) allows the company to develop more relevant and precisely tailored products. In an increasingly fragmented and multipolar world, this market proximity strengthens L'Oréal's ability to innovate with precision and relevance. Equally crucial for localizing brands and developing new products that align with current and future needs is the company's extensive collaborative network, comprising over 400,000 professional beauty salons, more than 3 million independent stylists, and nearly 300,000 doctors, pediatricians, and primary care physicians worldwide.

L’Oréal's sheer size is a significant advantage; it's larger than its second and third-largest competitors combined, and scale is absolutely critical in this industry. Generating repeat purchases and cultivating brands (in addition to enhancing product quality through innovation) demands substantial marketing investment. L’Oréal spends more than €14 billion annually on advertising (about a third of sales), making it the world's fourth-largest advertising spender across all industries. While advertising channels have dramatically shifted in recent decades, having negotiating power due to sheer scale remains a considerable competitive edge over rivals with tighter budgets. In fact, with a gross margin of 74%, the company could reinvest even more to boost product quality and reach new consumers with additional advertising campaigns without significantly impacting overall profitability.

Overall, L’Oréal has been able to navigate the industry’s evolving dynamics. In fact, it could even be said that it leapfrogged ahead of some. The company pioneered adopting an omnichannel approach in its supply chain and was an early investor in direct-to-consumer online sales, which now account for 28% of sales, up from 5% in 2015. This flexibility to make critical decisions quickly, without falling into the bureaucracy typical of a company of this size (€200 billion in market capitalization and 116 years of history), is rooted in its organizational DNA and corporate culture. L'Oréal stands out among its competitors because it uniquely combines strategic centralization with operational decentralization, all fueled by an entrepreneurial spirit. This distinctive model empowers local teams, ensuring both flexibility and excellence in execution.

L'Oréal is also unique in its high degree of vertical integration. It's not just a cosmetics brand; it's also an industrial powerhouse that manufactures the vast majority of the products it sells. This involves meticulously managing and streamlining its expansive global network of 38 production plants and 158 distribution centers to serve billions of consumers daily. The scale of its operations is reflected in a few key figures: it sells around 8 billion products each year and manufactures nearly 7 billion, meaning it produces almost 90% of its sales internally. This underscores a fundamental point: L'Oréal doesn't just design and develop its products; it also manufactures and distributes them globally, solidifying its status as a truly integrated industrial company. This widespread production and distribution network allowed it to gain market share in Asia when China's lockdown extended longer than anticipated. We're seeing a similar dynamic now with tariffs in the United States. L'Oréal's distribution and production network are vital, often-overlooked assets that have enabled the group to gain market share even amidst extreme uncertainty and macroeconomic weakness.

Furthermore, L'Oréal's presence across all geographies, market segments, and categories positively contributes to its M&A drive. Some might be surprised to learn that despite over a century of innovation in the beauty market, L'Oréal internally created only two of the 38 brands currently in its portfolio (L'Oréal and Kérastase). In fact, it could be argued that L'Oréal excels more at acquiring and scaling brands than at launching new products from scratch. The extensive information it gathers daily through customer interactions is vital for mitigating the risk of an acquisition failing. This is a common pitfall in this highly dynamic industry (remember Estée Lauder), where consumers constantly seek novel products to satisfy their demanding needs.

While it's true that barriers to entry are quite low, the hurdles to scaling a brand and achieving widespread success are significantly higher. Leveraging its robust distribution and manufacturing network, coupled with over a century of accumulated know-how, the company can acquire licenses for brands that haven't yet achieved global prominence but have demonstrated "something special," and then transform them into market leaders at scale. Rather than launching dozens of brands from the ground up (a common practice in other sectors), L’Oréal prefers to allow the market to function as a Darwinian selection mechanism. It identifies those few differentiating brands that have survived their early years in a highly competitive environment and then deploys its entire industrial, logistical, and marketing machinery to scale them.

The case of CeraVe offers a recent example, but it's one of many. Acquired in 2017 with a mere $140 million in revenue, it's now nearing $2 billion in sales. Its international growth has followed a clear pattern: identifying an entry market, leveraging medical or dermatological recommendations, and then expanding its positioning to mass retail channels without diminishing the brand's perceived value.

What's most intriguing isn't the individual success story, but the repeated pattern. Brands like La Roche-Posay, NYX, Skinbetter Science, Takami, Stylenanda, and Thayers follow the same blueprint: L'Oréal identifies them early, respects their core brand identity, and grants them access to an infrastructure they could never build independently. For L'Oréal, scaling doesn't mean standardizing; instead, it means amplifying what makes each brand special and connecting it with more consumers, more points of sale, and more distribution channels.

This approach makes the French group the default partner for independent brands. As such, L'Oréal can secure very long-term licensing agreements (sometimes spanning decades) for certain brands that other competitors can only dream of marketing, such as Valentino, Giorgio Armani, Yves Saint Laurent, and Ralph Lauren. This combination of distribution reach, global presence, scientific expertise, and the marketing muscle to transform local promises into global phenomena creates a formidable, difficult-to-replicate defensive moat that truly sets L'Oréal apart.

In an environment seemingly dominated by fragmentation and micro-segmentation, L'Oréal has demonstrated that true strength comes not from the number of brands, but from the ability to scale those with solid foundations. However, it's fair to ask how L'Oréal's goal of avoiding becoming just a collection of brands fits into a landscape that's perfect for launching small, alternative, independent brands with relatively little capital. While these small digital brands certainly help expand the potential market by introducing new products and categories, they could, in theory, also challenge large, mature, and established brands. The reality is, though, at least for L'Oréal, the rise of small, viral brands isn't a zero-sum game.

The French group's major brands are consistently gaining market share, and there are several reasons for this. First, the global cosmetics market is enormous, and L'Oréal still holds a relatively small percentage of the total. Second, consumers are starting to view mature, established brands that have adapted quickly as a reliable way to meet their needs without sifting through thousands of smaller brands. The array of choices can't expand endlessly, so it's reasonable to expect two models to coexist: innovative, differentiated small brands on one hand, and large brands that remain dynamic, digital, relevant, and adaptable on the other. Of course, the real challenge will be for those caught in the middle.

The rise of independent brands, particularly in emerging countries, was partly due to the limited presence of relevant, established brands. While digitalization enabled the emergence of new brands that are essentially marketing companies outsourcing manufacturing, it has also transformed consumption and distribution dynamics in favor of larger brands. For a long time, the distribution structure in emerging markets didn't favor L'Oréal. Selling cosmetics in small, scattered stores with limited storage and slow inventory turnover was inefficient for a company managing extensive catalogs with multiple shades, formats, and specialized lines. However, this has changed dramatically. The rise of e-commerce and platforms such as Shopee, Lazada, MercadoLibre, and TikTok Shop has allowed millions of consumers to discover, virtually try, and purchase L'Oréal products directly from their phones for home delivery. In geographies where it was once challenging to compete, L'Oréal has now gained both presence and relevance.

Furthermore, in a world characterized by an almost unlimited product offering, the algorithm has emerged as the primary influencer. Algorithms favor brands that generate higher search volumes, greater engagement, and ultimately, more sales. Far from eroding the power of established brands, the digital age has, in fact, amplified their visibility. L'Oréal's eight key brands—Lancôme, Yves Saint Laurent, L'Oréal Paris, Maybelline, Garnier, Kiehl's, Armani Beauty, and L'Oréal Professionnel—have consistently grown above both the group and market averages in recent years. In some instances, such as Lancôme and L'Oréal Paris in China, they have even achieved record sales. More recently, brands like CeraVe and Kérastase have joined this elite group, while others, including Helena Rubinstein, Valentino Beauty, and Prada Beauty, are on track to surpass €1 billion in annual sales.

Conversely, smaller digital brands will continue to face significant challenges in breaking the €50 or €100 million sales barrier. Regulatory complexities, the need to invest in robust infrastructure, and the inherent difficulty of scaling across multiple geographies will become increasingly formidable obstacles. Moreover, in a market saturated with options, consumer trust becomes an absolutely critical asset. In this new "attention economy," where every click and impression matters, large brands with clear purpose, strong execution, and a coherent narrative are better positioned than ever before. Therefore, the genuine threat to established players comes not from nimble small brands, but from being caught in the middle: lacking the agility of an independent brand while simultaneously lacking the scalable infrastructure of a global powerhouse. L'Oréal has successfully avoided this limbo and is well-positioned to continue doing so, as its competitive advantages show no signs of diminishing, and its corporate culture remains steadfast.

The fact that the business continues to widen its defensive moat doesn't necessarily mean the stock will deliver exceptional IRRs. I initially invested in L'Oréal in May 2020 at €246 per share and exited my position in July 2024 at €400 per share (a 14.5% CAGR including dividends), as I believed that the market was overly optimistic about the business's growth prospects and was valuing it at an excessively demanding multiple (around 30 times earnings). The stock's performance since my initial purchase had exceeded its historical average, and by then, I had identified more attractive opportunities to reinvest my capital.

Part of this strong performance can be attributed to an expanding multiple: the stock was somewhat depressed in May 2020, as the pandemic temporarily disrupted global dynamics and consumption habits. The post-COVID boom also contributed to the business exceeding its historical average growth rate in sales and earnings per share. In defensive businesses of this nature, characterized by a high terminal value, investing during periods of pessimism or uncertainty is often key to achieving returns above their long-term average.

Over the past year, L'Oréal's growth began to decelerate sequentially, partly because the global cosmetics industry is still suffering from a post-COVID hangover. Some investors are starting to grow impatient (which is often a positive indicator), but the reality is that, at €375, shares are still trading at 28–29 times estimated 2025 earnings and 26 times estimated 2026 earnings. I don't see any immediate catalysts that suggest the market will award it a higher multiple, so I expect the stock to trend in line with its earnings per share going forward.

So, what are L'Oréal's growth prospects, and what are the limits for a giant with €44 billion in sales and a €200 billion market capitalization? The truth is, while L'Oréal is the undisputed global leader—with a scale twice that of its second and third-largest competitors combined—its market share is still only 15% globally, and less than 10% in many markets around the world (it's barely 8% in India and Indonesia).

L'Oréal should be able to increase its sales by a CAGR of between 4% and 6% in the medium and long term, thanks to a multitude of factors. Global population growth, urbanization, the rise of the middle class (an estimated 2.4 billion more people will enter this social class in the next two decades), and digitalization are all structural tailwinds that will favor the business's development.

While the beauty market in developed economies is relatively mature, its penetration remains surprisingly low in many other regions. To put it into perspective, if North America, Western Europe, and Japan serve as benchmarks with a consumption index of 100, then Eastern Europe and Latin America barely reach 35. This drops to 20 in Asia and the Middle East, and plunges to just 10 in Africa. In other words, what we're seeing today could very well be just the prologue to a growth story yet to be fully written.

The aging global population will also significantly benefit L'Oréal. While older individuals may not purchase more products, they tend to spend more per unit. As consumers age, they increasingly seek specialized solutions, which particularly benefits the premium and dermocosmetic segments—L'Oréal's true crown jewel. Skincare is steadily gaining prominence over makeup, driving growth in higher-margin categories. Furthermore, older consumers generally exhibit greater loyalty to their preferred brands and are less susceptible to fleeting viral trends, strengthening the position of established companies with a global footprint.

Innovation will remain a strategic pillar, facilitating the launch of higher-value, and consequently more expensive, products. Both L'Oréal's robust pricing power and operational leverage should enable it to increase its earnings per share by 6% to 8% annually, provided it can grow its revenue at a rate of 1.5 to 2 times global GDP. As long as the company maintains its adaptability to sector dynamics and continues to integrate new brands into its global production and distribution network, an annual compounded return of 10% (including dividends) does not appear unreasonable. While this might not sound exciting to every investor, it's crucial to remember that L'Oréal remains a defensive consumer company. Return on invested capital should also continue to expand, especially for a company with the capacity to extend into new categories within markets where its infrastructure is already fully operational.

L'Oréal has not only showcased an exceptional ability to defend its leadership, but also to consistently reinvent itself and expand into new categories with significant structural growth potential. From the rise of dermatological cosmetics to the expansion into men's skincare, beauty supplements, and smart devices, L'Oréal is actively redefining the boundaries of competition within the beauty world. The success of divisions like dermatological beauty—currently its most profitable and fastest-growing segment—reflects not only an accurate reading of market trends but also the presence of difficult-to-replicate barriers, such as its privileged access to the medical channel.

Taken together, this ability to identify opportunities, mobilize industrial and commercial resources on a massive scale, and then scale new brands or categories in record time is what truly defines L'Oréal's defensive moat. It's a resilient, ambitious, and profoundly adaptive model that, while perhaps not the most exciting to some, remains, for me, one of the most admirable in the industry.

Next month's post will be about Novo Nordisk.